Filter results

Jun 25, 2025

10 min read

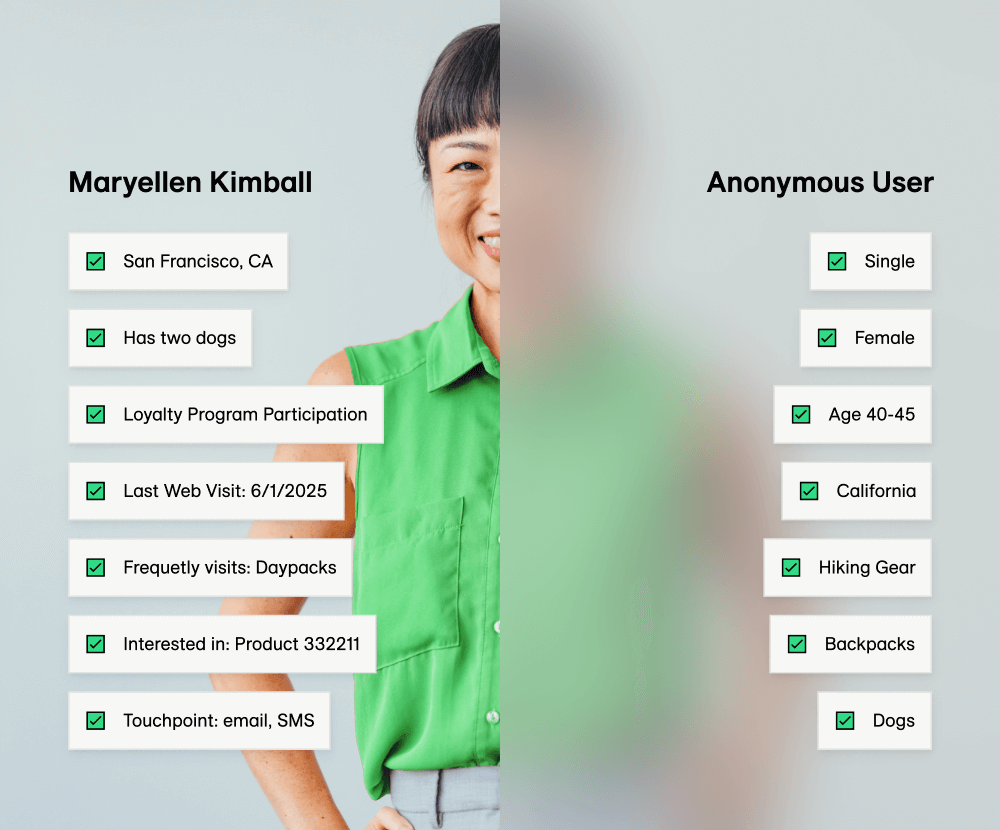

CDP vs. DMP: Understanding the Key Differences

Jun 24, 2025

5 min read

5 Cannes 2025 Takeaways Marketers Need to Know

Jun 24, 2025

9 min read

The Power of Connectivity: How LiveRamp Builds Bridges to Better Customer Experiences

Jun 23, 2025

4 min read

Building Retail Media Success: 4 Key Insights from Expert Guests Walgreens Advertising Group and Forrester Research

Jun 18, 2025

2 min read

LiveRamp Snowflake Native App Now Supports Datavant Token to RampID Resolution

Jun 12, 2025

4 min read